THE MARKETING PLAN

A marketing strategy will be designed around Let’s Pizza™ strengths, capitalizing on its technological innovation and boundless market potential. The campaign will target traditional media, social media, and the web - the last two being the pillars of Yay Food Technologies Ltd “viral strategy” to boost product awareness. To promote our product, Yay Food Technologies Ltd will participate in the best international trade shows in order to engage with innovation-loving journalists and bloggers. We will also organise an international road show to present our machines to the biggest and most influential players in the food industry. To sell Let’s Pizza™, a commercial team composed of internationally recognised F&B sales managers will contact the top international catering and vending companies, as well as leading convenience store chains. Some of the potential installation sites are listed below:

will be offered

to 3 market

segments:

VENDING

i.e. machines for offices, workplaces and crowded spots

RETAIL

i.e. bars and pubs, coffee shops, convenience stores, shopping centres and any spot with no kitchen facilities

HO.RE.CA

i.e. an integration of restaurant and canteen menus without any expensive equipment or cooking staff required

The Business Model

The Business Model

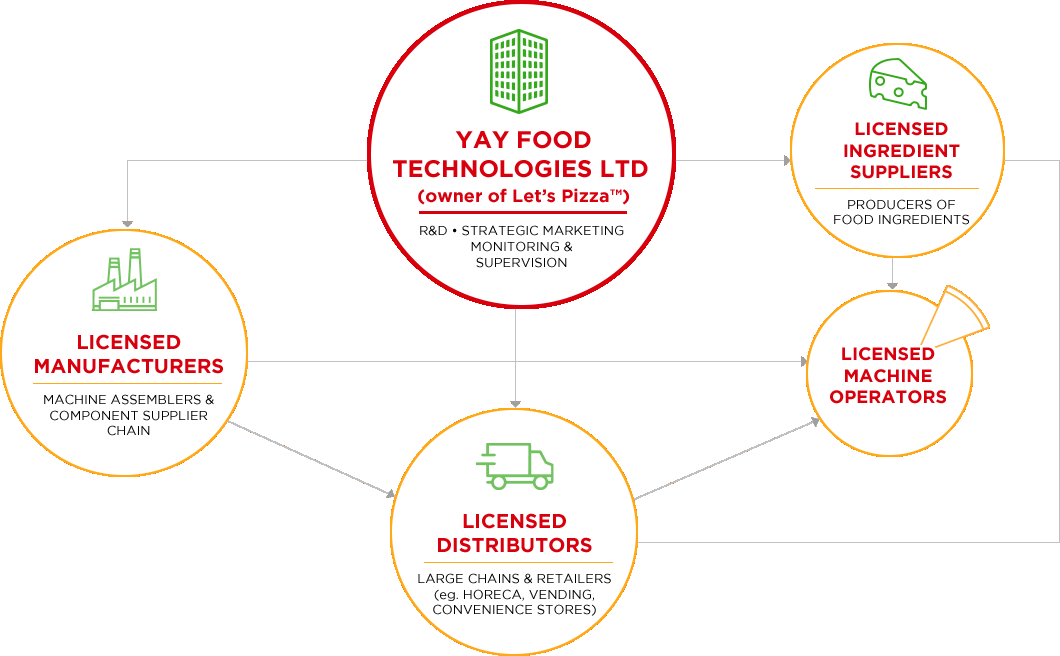

The diagram describes the business model of Yay Food Technologies Ltd (owner of Let’s Pizza™).

Yay Food Technology Ltd (owner of Let’s Pizza™) will focus on R&D, strategic marketing, monitoring and supervision of licensed suppliers, local distributors and food chain companies. Yay Food Technology Ltd will achieve this through “The triple licensing approach” which entails licensing machine suppliers, local distributors, and ingredient producers. Since the machine operates on IoT, and the sales of each pizza sold by the operator can be tracked, a comprehensive control of the process is enabled. This allows Yay Food Technology Ltd, along with its licensed partners, to have an all encompassing and transparent understanding of the business model. From efficient management of the whole process start-to-end, to preventing time delays, optimising costs, eliminating inefficiencies, and building a company focused on a franchise-based royalty approach.

Vending machine market

$128 BILLION

Market Overview

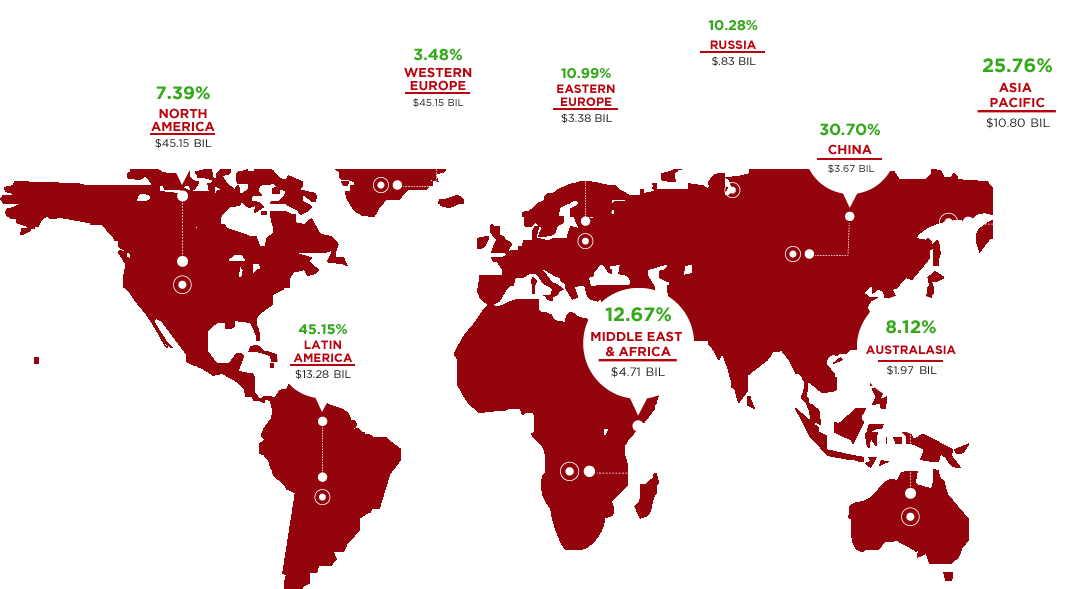

The global pizza

market is forecasted

to reach

$233 Billion US

Dollars in 2023

growing at a CAGR

of 10.17%, for the

period spanning from

2019 to 2023.

Factors such as a growing urban population, increased youth population, rapidly growing pizza market and the popularity of pizza franchise ownership are expected to further drive the market. A few notable trends include an accelerating online pizza delivery industry, pizza vending machines, a demand for frozen pizza, increased customer preference for gluten-free pizza, and a growing adoption of social media advertising tools. Due to the Covid-19 pandemic and its impact, there has been a huge demand, globally, for Home Delivery and Take Away (HDTA) pizza businesses. Further, the expansion of pizza chains in populous economies (such as China, Russia, India, the U.S., etc.) would be key for supporting market growth. Currently, the fastest growing regional market is Europe, owing to a rising demand for frozen and gluten-free pizza in Scandinavia, an increased penetration of online pizza delivery companies in France, and a growing adoption of multiple sales channels by domestic pizza outlets.

Geographic Locations

the united states

Annual sales of vending machines in the U.S. amounted to $64 Billion US Dollars, as of 2016, with over 6.9 million existing vending units. The U.S. is the biggest world market for pizza: 41% of consumers polled opt to eat pizza at least once a week. More than 1 in 4 of males aged 6-to-19 have pizza everyday. The U.S. consumes 13 kg of pizza, per person, per year - the greatest per capita rate worldwide.

europe

Europe alone counts 3.8 million vending units. 80% of these units are located in offices and the workplace. The total annual turnover amounts to €14.6 Billion Euros, equating to 80,000,000,000 items sold per day. The average European’s weekly expenses for vending products is €3.98 Euros. 58% of European consumers reportedly pass by a vending machine at least once a week.

china

The Chinese food service industry in 2019 was evaluated to be worth more than $814 Billion US Dollars. The vending sector in China incorporates high-tech components from inception. Japan’s Fuji Electric, which leads the vending machines supply in China, has doubled the production of high-tech machines to keep up with demand. Contact-less, smartphone-controlled payment is all the rage.